Atal Pension Yojana Scheme Chart - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

Understanding the Atal Pension Yojana Scheme Chart: A Step-by-Step Guide

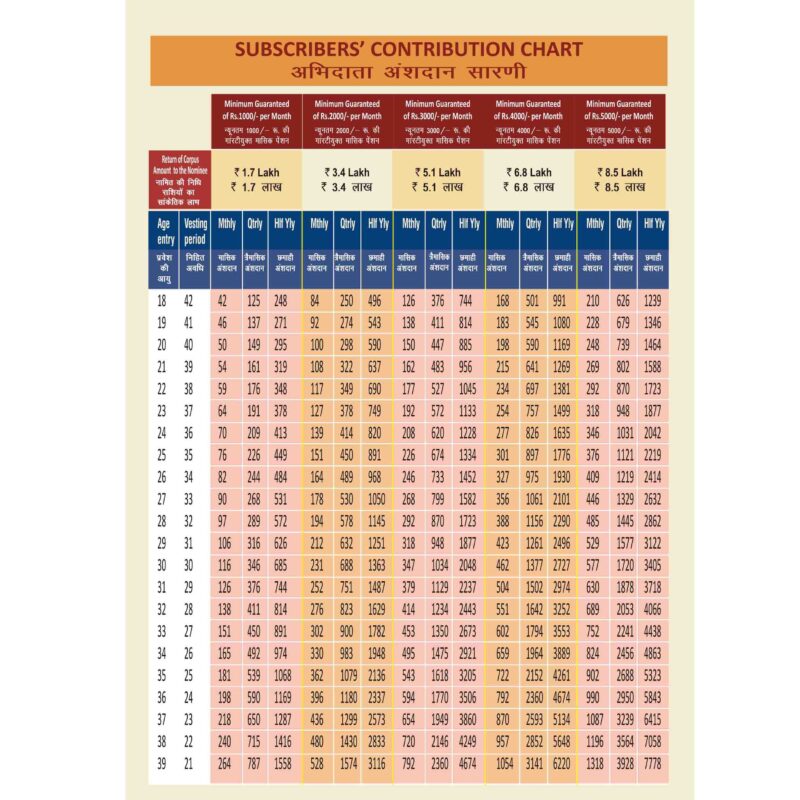

The Atal Pension Yojana (APY) scheme is a pension scheme launched by the Government of India in 2015. The scheme is designed to provide a pension to people in the unorganized sector who do not have access to any formal pension scheme. The scheme offers a guaranteed pension to its subscribers, and the pension amount depends on the contribution made and the age of the subscriber at the time of joining. In this blog post, we will discuss the Atal Pension Yojana scheme chart, which is a step-by-step guide to help you understand how the scheme works.

Eligibility

The first step in the APY scheme chart is eligibility. To be eligible for the APY scheme, you must be an Indian citizen between the ages of 18 and 40. You must have a savings bank account, and the bank account should be linked to Aadhaar. If you meet these criteria, you can proceed to the next step.

Choosing the Pension Amount

The second step in the APY scheme chart is choosing the pension amount. The pension amount ranges from Rs. 1000 to Rs. 5000 per month, depending on the contribution made and the age of the subscriber at the time of joining. To calculate the contribution amount, the subscriber needs to choose the pension amount they want to receive and their age at the time of joining.

For example, if a subscriber wants to receive a pension of Rs. 3000 per month and is 30 years old at the time of joining, the contribution amount will be Rs. 577 per month.

Choosing the Contribution Frequency

The third step in the APY scheme chart is choosing the contribution frequency. The subscriber can choose to contribute on a monthly, quarterly, or half-yearly basis, depending on their convenience.

Atal Pension Yojana SCHEME Chart

Rs. 1000 per month

Below calculator provides the approx monthly payment you would have to make to get a Atal pension of Rs 1000 each month. Basically if you start early you will have to pay less monthly and if you start late you have to pay more.

Age of CustomerYears to investMonthly PaymentPension AmountReturn to nominee18424210001.7 Lakh194145.910001.7 Lakh20405010001.7 Lakh213954.710001.7 Lakh22385910001.7 Lakh233764.610001.7 Lakh24367010001.7 Lakh25357610001.7 Lakh263482.510001.7 Lakh273389.710001.7 Lakh283297.610001.7 Lakh2931107.210001.7 Lakh303011610001.7 Lakh312912710001.7 Lakh322813910001.7 Lakh332715210001.7 Lakh342616610001.7 Lakh352518110001.7 Lakh362419810001.7 Lakh372321810001.7 Lakh382224010001.7 Lakh392126510001.7 Lakh402029110001.7 LakhSimilar calculation can be done for amount 2000. You just need to multiply column 3, 4 & 5 by 2 and you will get the amount.

Rs. 2000 per Month

Atal Pension Yojana calculator to get Rs 2000 monthly pension

Age of CustomerYears to investMonthly PaymentPension AmountReturn to nominee18428420003.4 Lakh194191.820003.4 Lakh204010020003.4 Lakh2139109.420003.4 Lakh223811820003.4 Lakh2337129.220003.4 Lakh243614020003.4 Lakh253515220003.4 Lakh263416520003.4 Lakh2733179.420003.4 Lakh2832195.220003.4 Lakh2931214.420003.4 Lakh303023220003.4 Lakh312925420003.4 Lakh322827820003.4 Lakh332730420003.4 Lakh342633220003.4 Lakh352536220003.4 Lakh362439620003.4 Lakh372343620003.4 Lakh382248020003.4 Lakh392153020003.4 Lakh402058220003.4 LakhRs. 3000 per month

Atal pension yojana investment required to get Rs 3000 pension

Age of CustomerYears to investMonthly PaymentPension AmountReturn to nominee184212630005.1 Lakh1941137.730005.1 Lakh204015030005.1 Lakh2139164.130005.1 Lakh223817730005.1 Lakh2337193.830005.1 Lakh243621030005.1 Lakh253522830005.1 Lakh2634247.530005.1 Lakh2733269.130005.1 Lakh2832292.830005.1 Lakh2931321.630005.1 Lakh303034830005.1 Lakh312938130005.1 Lakh322841730005.1 Lakh332745630005.1 Lakh342649830005.1 Lakh352554330005.1 Lakh362459430005.1 Lakh372365430005.1 Lakh382272030005.1 Lakh392179530005.1 Lakh402087330005.1 LakhRs. 4000 per month

Atal pension yojana investment required to get Rs 4000 pension

Age of CustomerYears to investMonthly PaymentPension AmountReturn to nominee184216840006.8 Lakh1941183.640006.8 Lakh204020040006.8 Lakh2139218.840006.8 Lakh223823640006.8 Lakh2337258.440006.8 Lakh243628040006.8 Lakh253530440006.8 Lakh263433040006.8 Lakh2733358.840006.8 Lakh2832390.440006.8 Lakh2931428.840006.8 Lakh303046440006.8 Lakh312950840006.8 Lakh322855640006.8 Lakh332760840006.8 Lakh342666440006.8 Lakh352572440006.8 Lakh362479240006.8 Lakh372387240006.8 Lakh382296040006.8 Lakh3921106040006.8 Lakh4020116440006.8 Lakh

Rs. 5000 per month

Atal pension yojana investment required to get Rs 5000 pension

Age of CustomerYears to investMonthly PaymentPension AmountReturn to nominee184221050008.5 Lakh1941229.550008.5 Lakh204025050008.5 Lakh2139273.550008.5 Lakh223829550008.5 Lakh233732350008.5 Lakh243635050008.5 Lakh253538050008.5 Lakh2634412.550008.5 Lakh2733448.550008.5 Lakh283248850008.5 Lakh293153650008.5 Lakh303058050008.5 Lakh312963550008.5 Lakh322869550008.5 Lakh332776050008.5 Lakh342683050008.5 Lakh352590550008.5 Lakh362499050008.5 Lakh3723109050008.5 Lakh3822120050008.5 Lakh3921132550008.5 Lakh4020145550008.5 LakhRelated Articles

- Atal Pension Yojana Scheme Details

- Atal Pension Yojana SBI

- What is a Pension Fund?

- RBL CSP Registration fee

- How to get a Debit Card

Conclusion

The Atal Pension Yojana scheme chart is a step-by-step guide to help you understand how the scheme works. The scheme is designed to provide financial security to people in the unorganized sector who do not have access to any formal pension scheme. The scheme offers a guaranteed pension to its subscribers, and the pension amount depends on the contribution made and the age of the subscriber at the time of joining. If you are between the ages of 18 and 40 and do not have access to any formal pension scheme, you should consider joining the Atal Pension Yojana scheme and secure your retirement.

Copy URL URL Copied

Send an email 13/04/20230 219 3 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print