How to Create a UPI ID: A Step-by-Step Guide

In the rapidly advancing digital era, Unified Payments Interface (UPI) has revolutionized the way we transfer money in India. UPI enables seamless and instant transactions between different banks using a unique identifier called a UPI ID. If you’re new to UPI and wondering how to create a UPI ID, this step-by-step guide will walk you through the process.

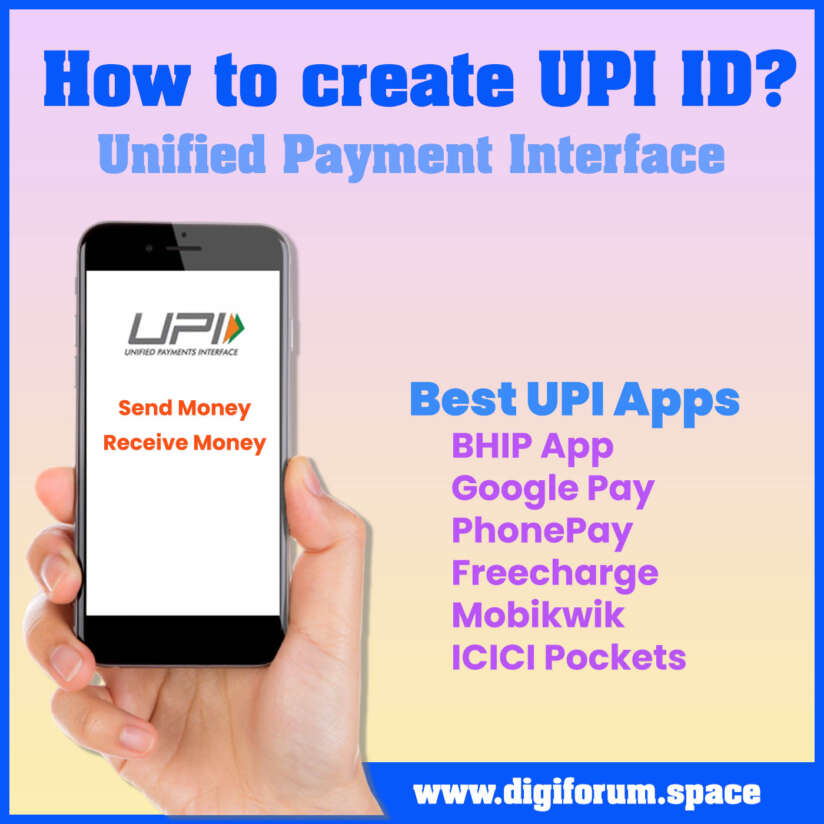

Step 1: Choose a UPI-Enabled App:

To create a UPI ID, the first step is to choose a UPI-enabled mobile app. Several popular apps in India support UPI, such as Google Pay, PhonePe, Paytm, and BHIM (Bharat Interface for Money). Install your preferred app from the Google Play Store or Apple App Store and launch it on your smartphone.

Step 2: Register and Set Up the App:

Once you have installed the UPI-enabled app, open it and follow the on-screen instructions to register your account. Typically, this involves providing your mobile number and linking it to your bank account. Verify your mobile number through OTP (One-Time Password) verification, and then select your bank account from the list of supported banks.

Step 3: Choose/Create a UPI ID:

After successfully registering and linking your bank account, you can now proceed to create your UPI ID. Most UPI apps offer two types of UPI IDs: a virtual payment address (VPA) and a UPI handle. A VPA is typically in the format “yourname@bankname” (e.g., johnsmith@icici), while a UPI handle can be a unique identifier of your choice (e.g., johnsmith123).

Step 4: Verify and Set Up UPI ID:

Once you have selected your desired UPI ID, the app will check its availability and prompt you to confirm the selection. If the UPI ID is available, you can proceed to set it up. Depending on the app, you may need to link it to your bank account or provide additional verification details.

Step 5: Secure Your UPI ID:

Security is paramount when it comes to UPI transactions. Ensure that you set up a secure UPI PIN or MPIN (Mobile Personal Identification Number) to protect your UPI ID. This PIN will be required whenever you initiate a transaction using your UPI ID, adding an extra layer of security.

Step 6: Start Using Your UPI ID:

Congratulations! You have successfully created your UPI ID. You can now start using it to send or receive money, pay bills, make online purchases, and more. Simply share your UPI ID with others, and they can initiate transactions to your ID directly from their UPI-enabled apps.

Tips and Best Practices:

- Keep your UPI ID simple and easy to remember.

- Regularly update your UPI-enabled app to benefit from the latest security features and enhancements.

- Be cautious of phishing attempts and never share your UPI ID or UPI PIN with anyone you don’t trust.

- If you change your mobile number or bank account, make sure to update your UPI ID settings accordingly.

- Familiarize yourself with the various features and services offered by your UPI-enabled app to make the most of your UPI experience.

Conclusion:

Creating a UPI ID is a straightforward process that enables you to experience the convenience and speed of digital transactions in India. By following the steps outlined in this guide, you can set up your UPI ID and start using it to send and receive money effortlessly. Embrace the power of UPI and enjoy the seamless payment experience it offers in the digital landscape.

FAQs – Frequently Asked Questions

Q1: What is a UPI ID? A1: A UPI ID, also known as a Virtual Payment Address (VPA), is a unique identifier linked to a user’s bank account for UPI-based transactions. It is used to send and receive money securely through the Unified Payments Interface (UPI) system in India.

Q2: How can I create a UPI ID? A2: To create a UPI ID, you need to follow these steps:

1. Download a UPI-enabled mobile banking app from your bank or a UPI-supported app from an authorized provider.

2. Complete the registration process by providing the required information, including your bank account details and mobile number registered with the bank.

3. Set up a UPI PIN, which is a four or six-digit secure code used for authorizing transactions.

4. Once your registration is complete, you can create your UPI ID, usually by choosing a unique username or selecting an available ID from the options provided by the app.Q3: Can I create a UPI ID without a bank account? A3: No, a bank account is mandatory to create a UPI ID. The UPI ID is linked to your bank account, allowing you to make transactions directly from your account.

Q4: Can I create multiple UPI IDs for the same bank account? A4: Yes, it is possible to create multiple UPI IDs for the same bank account. Some UPI apps allow you to add and manage multiple VPAs within a single account, making it convenient to have separate IDs for different purposes or to share with different contacts.

Q5: Can I change my UPI ID? A5: Yes, in most cases, you can change your UPI ID. The process for changing or updating your UPI ID may vary depending on the UPI app or bank you are using. You can usually find the option to edit or change your UPI ID within the app’s settings or profile section.

Q6: Is my UPI ID the same as my bank account number? A6: No, your UPI ID is not the same as your bank account number. It is a unique identifier specifically created for UPI transactions. While your UPI ID is linked to your bank account, it acts as a virtual address that simplifies the process of sending and receiving money securely.

Q7: Can I share my UPI ID with anyone? A7: Yes, you can share your UPI ID with anyone who needs to send you money through UPI. It is safe to share your UPI ID as it does not reveal sensitive information such as your bank account number or other personal details.

Q8: Can I use the same UPI ID with different banks? A8: No, each UPI ID is associated with a specific bank account. If you have multiple bank accounts, you will need to create separate UPI IDs for each account.

Q9: Are there any restrictions on choosing a UPI ID? A9: While creating a UPI ID, you may encounter certain restrictions. The UPI ID should typically be unique and may require adhering to certain guidelines such as a minimum length, specific characters, or limitations on special characters. The specific rules may vary depending on the UPI app or bank you are using.

Q10: Can I delete my UPI ID? A10: Generally, you cannot delete a UPI ID directly. However, if you no longer wish to use a specific UPI ID, you can deactivate or unlink it from your bank account by contacting your bank or the UPI app’s customer support. This will disable the UPI ID from accepting any further transactions.